17 maj The Best Forex Economic Calendar

A hotter services PMI print alluded to the continuing momentum of the US economy despite early signs in last months print (lower new orders and business activity/production in July). MULN stock has gained 1.7% in Friday’s premarket in sharp contrast to the leading equity indices. Part of the reason appears to be encouragement that Mullen management is fighting back against NASDAQ’s delisting announcement by attempting to appeal the decision. Coinbase CEO Brian Armstrong and Chief Legal Officer Paul Grewal are both optimistic on the dismissal of the SEC’s lawsuit against the crypto exchange platform.

The real-time Economic Calendar covers financial events and indicators from all over the world. The Real-time Economic Calendar only provides general information and it is not meant to be a trading guide. FXStreet commits to offer the most accurate contents but due to the large amount of data and the wide range of official sources, FXStreet cannot be held responsible for the eventual inaccuracies that might occur. The Real-time Economic Calendar may also be subject to change without any previous notice. For example, if a Nonfarm Payroll report is set to be released, traders will know that this indicator has the potential to move FX markets substantially as indicated by the ‘high’ importance. As such, awareness of the events’ timing means trader can plan their forex trades accordingly.

Main Forex Info

Forex economic calendar represents a time Table with a list of major economic events during the week. Event risk refers to anything that has the potential to influence markets but that cannot be predicted in advance. Please use the presented economic calendar to track significant news events and economic data releases that have the potential to shake up the financial markets and have an effect on your trading. The Forex market is traded 24/7 and is largely driven by economic news and data.

Gold (XAU/USD) Slipping into Multi-Week Support, Volatility Remains Low – DailyFX

Gold (XAU/USD) Slipping into Multi-Week Support, Volatility Remains Low.

Posted: Mon, 14 Aug 2023 07:00:00 GMT [source]

Next week Wednesday is the big one where we get further insight into US inflation a week before the Fed meeting. PPI data has also been known to cause dollar repricing in the past as PPI dynamics tend to lead CPI trends. US retail sales for August will then provide more insight into the strength of consumer appetite at a time when higher interest rates are meant to constrain spending. However, with an unemployment rate of under 4%, there is still a lot of money changing hands.

EIA Crude Oil Stocks change

As a forex trader, your job is to understand the chart patterns and signals provided by the economic calendar and make your forecast and trading pattern based on it. It would help you know when to enter and exit the market to feel the most advantageous and control your losses. If any, you must synchronize your trading pattern with the economic moves or events and trade that information at the right time. daily fx economic calendar An economic calendar is the calendar of forthcoming economic events that happen across the globe and is likely to impact various financial markets like currency, stocks, indices, bonds, and more. In any of the needs you trade, at any time, you have to keep yourself updated with the daily news. Being updated with significant economic events can have substantial effects even for long-term investors.

- Forex traders need to use a forex calendar to map important events that can change forex market prices in a tight time frame.

- The trader will not trade because the technical analysis plan is not confirmed using fundamental analysis (economic event).

- Our trading charts provide a complete picture of live currency, stocks and commodities price movements and underpin successful technical analysis.

High-impact news can influence the forex market, and these events must be observed. Conditions in the market might become turbulent due to high-impact occurrences, particularly in the foreign exchange market. Be aware of any forthcoming economic data releases or events that might result in unexpected volatility and adversely influence your trading, such as any open positions you may have. A forex economic calendar is useful for traders to learn about upcoming news events that can shape their fundamental analysis.

Charts

MULN has gained 1.7% in Friday’s premarket in sharp contrast to the leading equity indices. Once all settings have been selected, you may either “Set as Default” or simply hit “OK” to see the DailyFX Economic Calendar items populate on the chart. Using a very useful tool for FXCM’s Trading Station Desktop, you can now show the same information on the same charts you use to trade.

- No matter what period you trade on, it would help if you made it a habit to check the forthcoming events on the calendar every day.

- When an event listed on the calendar approaches, there may be expected a period of volatility if data is released well above, below or in line with expectations.

- Content distribution platform LBRY said late Thursday that it has filed a notice of appeal against a recent ruling that declared the LBC token as an unregistered security.

- Spot market EUR/USD Futures contracts since July traded 2-day highs at 300,000 contracts and a fairly normal 150,000 to 200,000 per day contracts.

- These indicators typically change ahead of any gigantic or significant economic adjustment event.

The Bank of England, led by Governor Andrew Bailey, keeps an eye on the economic climate in the United Kingdom, the world’s sixth-largest economy. London, the nation’s capital, is the world’s second-biggest financial hub after New York City. In the last group comes two indicators that reflect the average price stats for consumers and producers. You may know them by the Consumer Price Index and Producer Price Index. All statistics in this calendar are in expressed in nominal terms unless labeled ”real.” ”Real” statistics are inflation-adjusted using the most relevant deflator.

Using the Economic Calendar

Each and every economic event is labeled with an impact from no-impact to low, medium and high impact as well as the previous, consensus and actual result. Forex traders need to use a forex calendar to map important events that can change forex market prices in a tight time frame. For example, Forex fundamental announcements calendar or the forex news calendar can sometimes influence the market for https://g-markets.net/ several days, weeks, or months. Forex news calendars must always be adjusted to the trader’s current preference. A calendar needs to be filtered by date (pick day or week), filtered by currency (if you want EURUSD, then pick EUR and USD), and purified by impact news (low, medium, high). In addition, the Forex calendar needs to be adjusted by preferred time (usually, traders pick a local time).

You can select each event of interest to learn more information about it, the surrounding news and analysis, and also to add it to your email calendar, which can be done by clicking the ‘Add to Calendar’ button. Below, we click on the Fed Interest Rate Decision event to find out about its relevance. The European Central Bank is headed for a crunch rate decision next week amid rising recession risks and the job on inflation not yet done. It’s going to be a big week for the US dollar as well, as the CPI and retail sales reports are due before the Fed’s September meeting.

This piece will explore the DailyFX economic calendar in depth, offering tips on how to read a forex economic calendar to plan ahead, manage risk, and support strategic trading decisions. The currency market is also run by political and economic factors that hardly impact a currency’s strength or value. A forex calendar gives information on all such events and helps predict minor or significant changes. As a forex trader, if you can understand and analyze such factors or indicators, you can also know how they impact a nation’s economy. You would also see how you can take advantage of these changes in your trading.

The Last figure represents the most recently available data for each economic calendar indicator (data release frequencies vary; they may be from the previous month or quarter, etc.). We also provide a Consensus figure, which represents the average opinion of our experts about the indicator’s value. The Actual reading is updated in real-time and shown to the right of the instability gauge as soon as it becomes available. We have a public consensus that is either green (indicating that the statistics are improved than expected) or red (indicating that the data is worse than expected) (poorer than anticipated). The Aberration ratio is a unique metric developed by FXStreet that quantifies the degree to which Actual data deviates from the Consent. Keeping yourself updated with these data points can easily ace the trading and profit based on the forex calendar information.

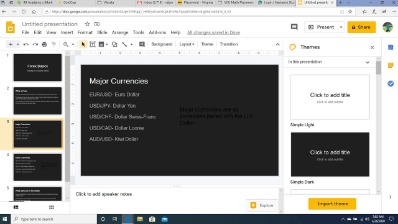

The weekly chart reveals the threat of an upside breakout after prices started this week above channel resistance but has since traded lower. The descending channel suggests that gold prices may find it difficult to see large moves to the upside. $1956 remains the level to watch if a longer-term bullish move is to develop. In the example in the image below, the search has revealed the upcoming Fed interest rate decision from the US, as well as key economic events from the Eurozone.