06 dec Free Stock, Commodity, Forex Tips & Research

Contents:

During his off hours as a dancer, he read some 200 books on the market and the great speculators, spending as much as eight hours a day studying. Showing how mistakes made in the recent market collapse were amazingly similar to those made in previous down cycles, O’Neil reveals simple steps investors can follow to avoid costly mistakes. When you place an order, you get the option of setting a stop-loss. This means that as soon as the stock price moves to a certain level, a trade will be executed, and your shares will automatically be sold. In this book, Howard Marks explains concepts such as “second-level thinking,” the price/value relationship, patient opportunism, and defensive investing. He does an honest assessment of his own decisions, including his mistakes, and provides valuable lessons for critical thinking, risk-assessment, and investment strategy.

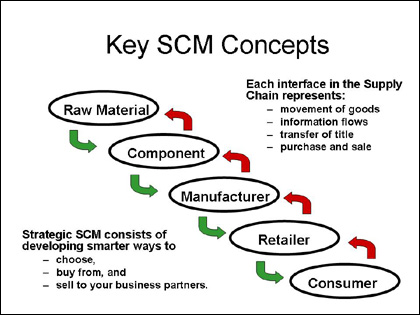

Darvas designed the theory as a method to target high-momentum stocks with increasing trading volume. It makes use of market momentum concept and technical analysis to determine when to enter and exit the market, also it uses fundamental analysis to determine what to buy or sell. If the price breaks out of the box, it is a sign of a breakout. In this way, the Darvas box helps investors determine what price to enter and exit the market. The given theory is known to encourage the traders to emphasize the industries that are growing –implying the industries in which the investors think that they could outperform in the given market. During the development of the given system, Darvas moved forward by selecting a few stocks from the given industries and analyzed the overall prices as well as trading on a daily Basis.

What listeners say about How I Made $2,000,000 in the Stock Market

I liked the way he believed one day he will make money from market and also tried different methods to improvise his techniques. This is an inspirational story for all of them who are struggling in market. To check whether stocks are showing signs of improvement, it would be inefficient to go personally over hundreds of stocks. It would be wise to perform a google search for “ Darvas Box Indian Stocks” which would provide you with a bunch of stocks that people believe are showing signs of breaking out from a box. Think of it this way – a seatbelt protects you in a car accident and a stop-loss protects you in the stock market.

- Topics covered include the difference between stocks and businesses, what constitutes a good business, when to buy and sell stocks, and how to value individual stocks.

- With solid research and in-depth analysis Equitymaster is dedicated towards making its readers- smarter, more confident and richer every day.

- This instance may not be a valid Darvas field as a result of I didn’t verify whether or not it is at a yearly excessive but look at the purchase and sell costs.

- In stock markets, getting a hold of your emotions, investing tendencies and psychology is one of the most difficult battles you will face.

- If the price breaks out of the box, it is a sign of a breakout.

This information is then formulated in an index form, which further helps in narrowing down the RSI score ranging between 0 and 100. Once the RSI increases or decreases to a specified limit, you can modify your trading strategy. These are the vital pointers shared by trading indicators. These basic, but beneficial pointers help in assessing the market conditions and allow traders to make better decisions with respect to trade positions.

Chapter 2 Entering Wall Street

There are methods like The Fibonacci retracement and patterns like Head and Shoulder etc. out there. Unfortunately, though, these methods are very complex in nature and most certainly not for beginners. While this sounds weird for trading – doing this will ensure that even if you have a temporary setback, you can always get back on track by not suffering a capital loss. It is recommended that you buy the kindle version of this book, as it is very reasonably priced and the letters get updated every year for free. We often hear about big successes in the markets, but seldom about failures.

I must accept this fact and readjust myself accordingly – my pride and ego would have to be subdued. I decided that if a usually inactive stock suddenly became active I would consider this unusual, and if it also advanced in price I would buy it. I would assume that somewhere behind the out-of-the-ordinary movement there was a group who had some good information.

How to Trade in Stocks

He also made it important to prefer https://1investing.in/ that revealed stronger Earnings over the period of time –especially if the overall market appeared to be choppy. As the highs and lows are updated over time, it is observed that the rising boxes and falling boxes are created in the process. The given theory is known to suggest that only trading with the help of rising boxes while using the highs of the give boxes that might be breached for updating the stop-loss orders. The Darvas Box Theory is a type of trading strategy that was introduced by Nicolas Darvas. As per the Darvas Box Theory meaning, it is aimed at targeting stocks with the help of highs while using volume as the major indicator. Darvas had developed the given theory during the 1950s, when he was traveling around the world in the form of a professional ballroom dancer.

There are short-period cycles that are unrelated to the bullish or bearish market trends. In such cases, it is easy for day traders to miss out on such changes, which is when the momentum oscillator is beneficial. This indicator is depicted within a range of 0 to 100 and is advantageous when the price has achieved a new high or low, and one wants to determine whether it will further rise or fall. In other words, the momentum oscillator helps to understand when the market sentiments are undergoing modifications. Be it a beginner or an established trader, following the basic intraday tips is a common practice before starting the trading day.

Generations of readers have found that it has more to teach them about markets and people than years of experience. This is a timeless tale that will enrich your life—and your portfolio. Darvas is said to have read more than 200 of the best books on the market by the great speculators. His unique approach and plan for trading stocks made him $2,450,000 fortune in just 18 months. Its more of an investor pshycology and how to approach investing in stock market. Learn how to buy and sell from someone who knows how to watch, wait, and profit from market signals.

What is Nicolas Darvas’ system? – New Trader U

What is Nicolas Darvas’ system?.

Posted: Thu, 16 Jun 2022 07:00:00 GMT [source]

The book describes his unique ”Box System”, which he used to buy and sell stocks. Darvas’ book remains a classic stock market text to this day. And while you might not be a financial professional, that doesn’t mean you can’t win this battle. Through interviews with twelve ordinary individuals who have worked hard to transform themselves into extraordinary traders, Millionaire Traders reveals how you can beat Wall Street at its own game. Filled with in-depth insights and practical advice, this book introduces you to a dozen successful traders.

How I Made $2,000,000 In The Stock Market

It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Moreover, like any other strategy, momentum may cease to work if not applied with discipline. One has to monitor the market daily and time one’s entry and exit. The liquidity injected by central banks all over the world added a boost to growth sectors such as technology. As I followed the crowd I also started to act like this. Instead of being a lone wolf, I became a confused, excited lamb milling around with others, waiting to be clipped.

However, your trading strategy changes with time and the concurrent events play a huge role in its working. In order to maximize returns, it is essential to understand the market. Trading indicators are beneficial tools that are used with a comprehensive strategy to maximize returns. The Darvas Box strategy was developed by Nicholas Darvas.

Using intraday trading indicators help in averting risk and placing appropriate trades based on technical analysis and market sentiments. Angel One offers detailed charts and stock analysis reports that comprise these trading indicators. These tools help in planning an effective trading strategy, while minimizing risks. As you update the highs and lows over time, you will see rising packing containers or falling bins. Darvas box concept suggests solely trading rising packing containers and using the highs of the boxes which might be breached to replace the cease-loss orders.

As his capital grew, he would allocate capital to varied stocks. One of the best book explainjng how to keep things simple in stock market. Have seen many you tube videos by randkm guys applyimg same principle given in this book.

Before emigrating to America, Darvas studied economics on the University of Budapest. Gamble…I must study this strategy (originally this approach was fundamental analysis, which didn’t work for him, so he developed his Darvas Box trading method). Their movement is determined by an upper and lower limit. These limits act as a perimeter which the author called “boxes”. Darvas believed investors should not allow themselves to hold on to a loser or sell a winner. He felt the key to achieve this was to forget about their ego the moment they start trading in the financial markets.

Lessons From A Market Great: Nicholas Darvas – Seeking Alpha

Lessons From A Market Great: Nicholas Darvas.

Posted: Mon, 23 Jul 2018 07:00:00 GMT [source]

The author started including stop loss in his orders so that just when the stock falls below the expected price, he would not own them. Later he bought 200 shares of Pittsburgh Metallurgical and incurred a loss of $2023. After an extensive analysis, he found that he had bought the stock at the top of an 18-point rise.

The darvas box theory box theory is not locked into a particular time interval, so the bins are created by drawing a line alongside the current highs and up to date lows of the time interval the dealer is using. The Darvas Box theory was developed by Nicolas Darvas in 1950s while travelling the world as a ballroom dancer. A Hungarian by birth, Darvas claims to have converted $10,000 investment into $2 million within just 18-months by investing in the US stock market.