21 apr Capitalization of Interest Cost During the Construction of Assets

The approach chosen should be selected to provide a close approximation of the typical amount committed throughout the period. In case after reading and analysing the cash flow calculation of the company from its annual report, you have any query, then I would be happy to provide my inputs on your analysis and query resolution. Is such an application of “capitalization” limited only to plant creation? Or similar mode of treatment can be applied to other “operational expenses “as well, company might be capitalizing the interest cost meaning like procurement of raw materials, as indicated in below mentioned hypothetical scenarios. In the video of profit & loss (P&L) statement, you have said that the debt of ₹1,000 crores plus ₹200 crore interest becomes the value of the fixed asset as ₹1,200 crores after capitalization. In the event of litigation, we may send records to the Department of Justice, a court, adjudicative body, counsel, party, or witness if the disclosure is relevant and necessary to the litigation.

It is paying this interest as you would understand that banks will not allow it to escape interest. However, it is not mentioning the interest on debt taken for any new plant/fixed assets in the P&L. If you are not required to make a payment this month, you won\’t be considered past due if you don\’t make a payment or pay less than your regular monthly payment amount. However, we encourage you to continue paying as much as you can, because interest may continue to accrue on your outstanding principal balance.

Understanding Cash Flow from Operating Activities (CFO)

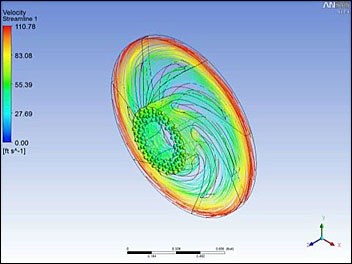

For the latest information regarding the status of student debt relief, visit StudentAid.gov. This relieves cash flow pressure from borrowers but creates higher debt obligations in the future. Heavens Energy is constructing a wind farm off the coast of Cape Cod, Massachusetts.

Full-time employment means working 30 or more hours a week in a position expected to last at least 3 consecutive months. You will receive notification within 7-10 business days when your request has been processed. The information you provided doesn\’t follow the username requirements or the email address cannot be used.

The Differences Between Interest Coverage Ratio & Fixed-Assets- to Long-Term-Liabilities Ratio

Capitalized interest is calculated the same way as any other type of interest. The prevailing rate of interest is multiplied by the prevailing principal balance of debt for a given period, and considerations are made for the number of days outstanding. This balance is then added to the original principal balance amount, so it may be wise to sometimes track the original principal balance and the balance of interest that has accumulated. In some cases, accrued interest and capitalized interest can be the same. For example, if an unpaid amount of interest is added to the balance of the principal, the amount of accrued interest is considered the same as the amount of capitalized interest.

- On this loan, the amount of interest that accrues (adds up) each day is $1.86 (see “How Interest Is Calculated” above).

- When a company capitalizes its interest and adds the cost to its long-term asset, it effectively defers the interest expenses to a later accounting period.

- Let us assume a hypothetical case where there are no taxes applicable to the company.

- But anything you put toward the loan will reduce the amount of interest that you capitalize.

If you want to direct future online payments to an individual loan instead of directing to a loan group, you may request that your loans be ungrouped by calling us at the number above. For more information on making online payments, see How To Make a Payment. Capitalizing interest means adding unpaid interest to a loan’s principal balance. This implies that the interest will accumulate on a larger principal balance, and the borrower will pay more interest over the life of the loan. You might not have much control over the interest rate, especially with federal student loans. But you can control the amount you borrow, and you can prevent that amount from growing on you.

Capitalized Interest Example

When we capitalize interest (₹200 cr), then first, we increase the value of the fixed assets by the value of interest (₹200 cr) and second we do not deduct this interest amount in the P&L as an expense. Therefore, we increase the profit before tax (PBT) by an amount equal to the capitalized interest (₹200 cr). At the end of the deferment, the accrued interest of $340 will capitalize (be added to your principal balance).

Establishing a Business in Quebec: Practical Considerations … – Fasken

Establishing a Business in Quebec: Practical Considerations ….

Posted: Mon, 31 Jul 2023 20:37:38 GMT [source]

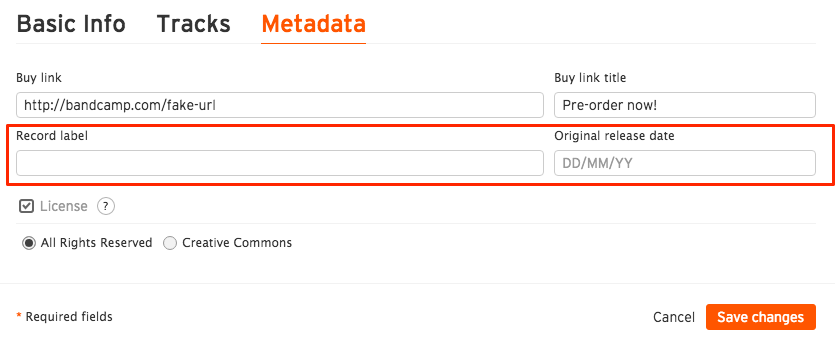

Capitalization is the addition of unpaid interest to the principal balance of your loan. Capitalization causes more interest to accrue over the life of your loan and may cause your monthly payment amount to increase. Table 1 (below) provides an example of the monthly payments and the total amount repaid for a $30,000 unsubsidized loan.

Capitalization means adding unpaid interests on the loan after a given grace period. It occurs under the interest capitalization rule, which allows companies to add the accrued interest on the loan amount. E.g., a sales company, ABC, takes a $100,000 loan and will pay a total of $5,000 for the life of that loan. If they use the interest capitalization rule for this loan, the amount that will appear on their balance sheet will be $105,000.

thoughts on “Understanding Capitalization of Interest & Other Expenses”

It can begin using each of the wind turbines as they are completed, so it stops capitalizing the borrowing costs related to each one as soon as it becomes usable. Capitalization through equity funding involves the investment of the owners, which can take on many forms. Investors can own stock or shares in your business, or partners can be issued partnership interests. Whether you want to launch a business or grow it, you may have the need to capitalize it. And in doing so, there are things to consider as you open your doors, or take your business to the next level. Interest capitalization involves paying interest on interest (compounding) and should be avoided if at all possible.

- The only difference between capitalized interest and expensed interest is the timing in which the expense shows up on the income statement.

- Taking out a loan can also can increase your debt-to-equity ratio, which can paint the business in a negative light.

- Individuals can get rid of capitalized by negotiating with lenders to remove it or trying to refinance their outstanding loans.

- A business that issues stocks to investors, whether via private transactions or public offerings and stock exchange trading, may have investors with a ”majority interest” in the company.

- You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run.

- Companies may be interested in capitalizing interest if they want to defer the interest expense deduction to future periods.

The capitalized interest definition is the interest on the cost of construction, or a self constructed asset by a company. Interest capitalization occurs because it is a part of the cost in developing the asset for the company’s future use. A daily interest formula determines the amount of interest that accrues (adds up) on your loan each day. This formula consists of multiplying your loan balance by the number of days since you made your last payment and multiplying that result by the interest rate factor. You can find your interest rate factor by dividing your loan’s interest rate by the number of days in the year.

The remainder was financed out of nonspecific borrowing with a rate of 9%. Only thing is that an investor should know that ₹3,500cr debt would never have only ₹25 cr of the interest cost. The actual interest paid in a year, which should be about ₹350cr considering 10% rate of interest. Total debt is also available in the datasheet of the Screener export to excel as “Total borrowings”. Say you have a $10,000 Direct Unsubsidized Loan with a 6.8% interest rate.

A Costly Situation for Businesses: Section 174 Capitalization is Here – CLA (CliftonLarsonAllen)

A Costly Situation for Businesses: Section 174 Capitalization is Here.

Posted: Fri, 20 Jan 2023 08:00:00 GMT [source]

Summary

This Statement establishes standards for capitalizing interest cost as part of the historical cost of acquiring certain assets. To qualify for interest capitalization, assets must require a period of time to get them ready for their intended use. Examples are assets that an enterprise constructs for its own use (such as facilities) and assets intended for sale or lease that are constructed as discrete projects (such as ships or real estate projects). Interest capitalization is required for those assets if its effect, compared with the effect of expensing interest, is material. If the net effect is not material, interest capitalization is not required.

Capitalization of Interest Cost During the Construction of Assets FAQs

The following example assumes that the project began in 2015 and finished at the end of 2016. During this period, $100,000 would have been capitalized in 2015, another $200,000 in 2016, and $50,000 in 2017. According to the aicpa statement of position 97-2, ”interest is capitalized during construction when it relates to major additions or improvements.” The year-end expenditure base is thus $300,000, or $400,000 less $100,000. The average accumulated expenditures for 20×1 are $150,000, or one-half of the sum of the beginning and ending totals ($0 plus $300,000).

The example loan has a 6% interest rate and the example deferment or forbearance lasts for 12 months and begins when the loan entered repayment. The example compares the effects of paying the interest as it accrues or allowing it to capitalize. Capitalized interest is the total sum of unpaid interest that is added to the principal loan. It is a significant aspect of financing that helps a business grow and expand as it generates more income and helps a nosiness fund more projects. Interest capitalization applies to long-term assets, for example, when borrowing money to construct a new building or purchase equipment. Long-term assets are things a business owns and will not be converted into cash in a year or less.

However, in many cases, the benefit in terms of information about the entity’s resources and earnings may not justify the additional accounting and administrative cost involved in providing the information. The significance of the effect of interest capitalization in relation to the entity’s resources and earnings is the most important consideration in assessing its benefit. The ease with which qualifying assets and related expenditures can be separately identified and the number of assets subject to interest capitalization are important factors in assessing the cost of implementation. The company capitalizes interest by recording a debit entry of $500,000 to a fixed asset account and an offsetting credit entry to cash. At the end of construction, the company’s production facility has a book value of $5.5 million, consisting of $5 million in construction costs and $500,000 in capitalized interest.

Capitalized interest is the cost of the funds used to finance the construction of a long-term asset that an entity constructs for itself. The capitalization of interest is required under the accrual basis of accounting, and results in an increase in the total amount of fixed assets appearing on the balance sheet. An example of such a situation is when an organization builds its own corporate headquarters, using a construction loan to do so. It’s important to note that not all student loans accrue interest during a deferment period, and some loans may have interest subsidies that cover the interest during that time.

A grace period is a period after the due date of a payment during which a borrower may make the payment without being subject to a late fee. The accrued interest amount is then added to the current principal amount, and the interest is calculated from the new principal amount. Interest is mainly capitalized when a company needs to finance long-term assets such as building a new office or warehouse. Interest cost along with other costs of creating the plants/fixed assets like land, building, machinery, logistics etc. are capitalized. The logic is that even though these costs are incurred in the year in which the plant/fixed asset is created, however, the plant runs a longer life and keeps on producing goods for many years.