03 okt Bond Accounting Record Entries for Par, Discount & Premium Bonds

Content

Take time to verify the factors by reference to the appropriate tables, spreadsheet, or calculator routine. The present value factors are multiplied by the payment amounts, and the sum of the present value of the components would equal the price of the bond under each of the three scenarios. Bond payable due after an operating period will be reported as long-term liability. The portion of the mortgage that will be paid within the operating period will be classified as the current portion of long-term debt, and the remaining will be reported as long-term debt. Gain on redemption of debt will be reported as other income in the income statement of the business entity.

- The balance in an unamortized discount on bonds payable b) should be reported on the balance sheet as a deduction from the face amount of the related…

- Investors who would rather buy a bond with a higher coupon will have to pay a premium to the higher-coupon bondholders to incentivize them to sell their bonds.

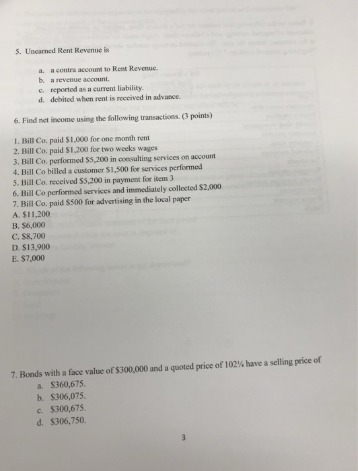

- When sales taxes are not rung up separately on the cash register, total receipts are divided by 100% plus the sales tax percentage to determine sales.

- A bond will appear on the balance sheet at its face amount; its unamortized premium or discount will appear on the income statement.

Principal payment. Series of equal cash receipts at fixed intervals. Balloon payment.

BONDS PAYABLE (INTERMEDIATE ACCOUNTING …

This liability is initially recognized as an increase in the carrying amount of the related asset . The journal entry is to debit the asset and credit the liability. The initial recognition of a liability for an ARO is not recognized in the income statement. One source of financing available to corporations is long‐term bonds. Bonds represent an obligation to repay a principal amount at a future date and pay interest, usually on a semi‐annual basis. Unlike notes payable, which normally represent an amount owed to one lender, a large number of bonds are normally issued at the same time to different lenders.

When the effective interest rate method is used, the amortization of the bond discount a. Decreases interest expense each period. Increases interest expense each period. Increases interest expense in some periods and decreases interest expense in other periods. Has no effect on the interest expense in any period. A bond is a.

Free Financial Statements Cheat Sheet

Convertible bonds can be converted into common stock at the bondholder’s option. Until the withholding taxes are remitted to the government taxing authorities, they are carried as current liabilities. Identify the requirements for the financial statement presentation and analysis of liabilities. Prepare the entries for the issuance of bonds and interest expense. As we note from the table below, the ending balance amount moves towards the face value of the bond at maturity.

The bonds will sell for their face amount. The bonds will sell for more than their face amount. The bonds will sell for less than their face amount. None of these choices are correct. The PV of each periodic interest payments for each maturity is calculated separately, based on these different yield rates, just as w/ separate term bonds.

Amortization of Bonds Premiums & Discounts:

For example, let’s assume that when interest rates were 5% a bond issuer sold bonds with a 5% fixed coupon to be paid annually. After a period of time, interest rates declined to 4%. New bond issuers will issue bonds with the lower interest rate.

- Amortization of the premium decreases the amount of interest expense reported each period.

- Assume that a corporation prepares to issue bonds having a maturity value of $10,000,000 and a stated interest rate of 6%.

- See Table 4 for interest expense and carrying value calculations over the life of the bonds using the effective interest method of amortizing the premium.

- To further explain, the interest amount on the $1,000, 8% bond is $40 every six months.

- These bonds reduce the risk that the company will not have enough cash to repay the bonds at maturity.

- The issue price is a function of the market interest rate.

If the amount received is less than the par value, the difference is known as the discount on bonds payable. In accounting, bonds payable a liability account presented in the balance sheet. It contains the amount owing by the issuer to bondholders.

Prepare the adjusting journal entry needed on December 31, 2018. Prepare the adjusting journal entry needed on December 31, 2017. Indicate how each of these items should be classified in the financial statements. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups. A. Amortized over the remaining orginal life of the retired bond issue.

- B. The total effective interest is equal to the amount of the discount plus the total cash interest paid.

- An unamortized bond premium is booked as a liability to the bond issuer.

- Which of the following is true regarding the reporting of bonds in the financial statements?

- Provided only upon the written request of a stockholder.

- Bonds that require the bondholder, also called the bearer, to go to a bank or broker with the bond or coupons attached to the bond to receive the interest and principal payments.

On the CPA exam, bonds are similar to the Lion King as the effective interest method is can be thought of as the circle of life! The reality is that there are two major component of a bond that the FAR exam wants you to the balance in unamortized premium on bonds payable should be know about. They want you to know the rules… The type of lease described above is called a capital lease because the fair value of the leased asset is capitalized by the lessee by recording it on its balance sheet.

What happens to premium on bonds payable?

Premium on bonds payable is the excess amount by which bonds are issued over their face value. This is classified as a liability on the books of the issuer, and is amortized to interest expense over the remaining life of the bonds.